By Intelligent Insurer

The Greek economy has been in recession since 2010 and has the lowest level of insurance penetration in the EU. Nevertheless, there are pockets of growth and optimism, says Gerry Tighe, head of treaty at reinsurance broker MATRIX.

The troubles of Greece have made major headlines across the world. The crisis has also had a severe impact upon the premium volumes of the insurance market. However, there is now cause for a degree of optimism.

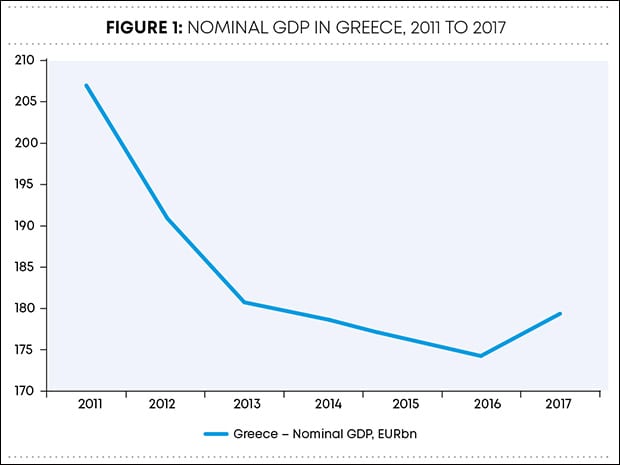

Finally, in 2017, it appears that Greece turned a corner and posted a year-on-year increase in gross domestic product (GDP) (Figure 1). There are now signs that the insurance market is also starting to rebound.

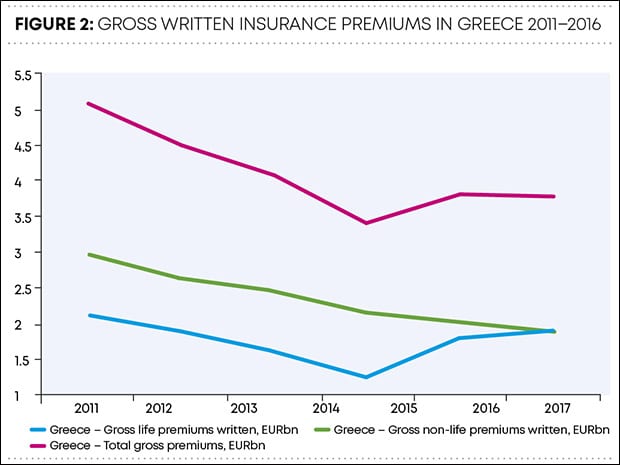

The insurance market suffered considerable reductions in premium income: between 2011 and 2014 there was a reduction of one-third of the combined life and non-life premiums (Figure 2). Life premiums started to recover in 2015 although 2017 showed a small decline of 2 percent.

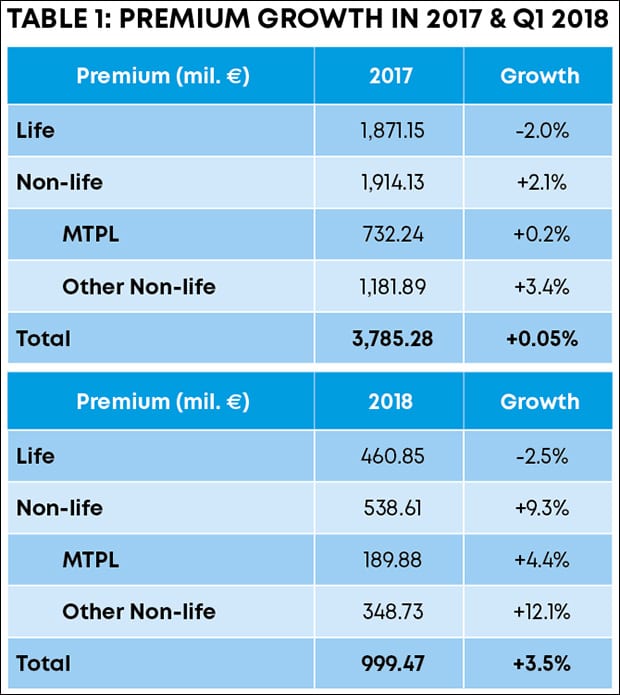

The decline of the non-life branches has been more protracted, returning to growth in 2017 and the first quarter of 2018 as shown in Table 1.

Motor results highly profitable

One bonus for the market during these difficult times has been the dramatic improvement of motor loss ratios. Because there was significantly less traffic on the roads, the frequency and the severity both reduced considerably for motor third party liability insurance (MTPL).

In 2007 the MTPL loss ratio was 72 percent; this had reduced to 50 percent in 2011 and 2012. Needless to say, this attracted competition and several freedom of services managing general agent operations entered the market, putting pressure on rates.

In 2016 the loss ratio stood at 62.5 percent after 12 months. The number of uninsured vehicles is expected to drop as a result of state intervention and fines already sent to the owners of these vehicles. This could increase the total insured fleet by up to 500,000 vehicles.

Life, health & private pensions

The crisis has added insecurity to the intrinsic volatility of the local business environment. Greece has started to implement fundamental financial reforms in the face of account deficits in the Greek economy.

This implementation of measures left Greece with deteriorating household incomes and waning investor confidence. Although the insurance sector is being called upon to play an active role in the Greek market and leave a positive footprint on society in general, the social security fund for entrepreneurs and professionals—EFKA—has strained all available income for life, health and pension insurance plans.

With EFKA contributions up to €1,580 ($1,865) per month and a total lack of fiscal or other incentives, the life, health & pensions insurance sector is limited to a rather passive role, waiting for the much-discussed social security transformation that will allow a three-pillar health and pension system and will re-establish stability, trust and proactive care for all citizens.

Highly educated staff plentifully available

Greece still suffers from high unemployment especially within the under 35s. In the 25 to 34 age group it has now reduced to 26 percent in 2017, down from 30 percent the previous year. A 24-year-old employee in Greece earns an average of €380 ($450) per month. Insurance companies are able to employ university educated staff at under €600 ($700)per month.

Ethniki Insurance

After the expiration of Greece’s National Bank’s (NBG) potential deal to sell a 75 percent stake of its wholly-owned insurance subsidiary to Exin Financial Services, China’s Fosun expressed its interest. Fosun lost out to Exin and Calamos Asset Management in a tender to buy the NBG’s insurance business last June.

The successful bidders offered €718 million ($882 million) for a 75 percent stake in Ethniki. NBG’s estimations for a positive outcome will be confirmed by the end of May and if negotiations fail, the bank might consider a 51 percent stake initial public offering.

Greek Motor Auxiliary Fund

It is expected that the final bidders interested in the buy-out and management or refinancing of the auxiliary fund will be announced during May.

Data sources: Bank of Greece, Hellenic Association of Insurance Companies, Katermerini newspaper & BMI Research.

Gerry Tighe is head of treaty at MATRIX. He can be contacted at: gerry.tighe@matrix-brokers.com